We recently had the opportunity to chat with Todd Miller (ChromaWay VP of Business Development), an expert in Real World assets and a key player in developing our Ledger Digital Asset Protocol (LDAP).

Key Takeaways

- The on-chain RWA market is hitting record highs and has grown consistently despite the bear market.

- The LDAP is a feature-rich protocol offering several advantages over other RWA solutions.

- The protocol is already in use on EVM chains, and the Chromia version is set to be released in 2024.

- LDAP on Chromia will have advantages over the EVM version, including greatly increased on-chain storage capability, a smoother end-to-end user experience, and significantly reduced transaction costs.

- According to Miller, “...it's clear that this transformation will significantly affect all asset types in the investing and lending arenas.”

Read on for the full Q&A!

Introduction

Todd, could you outline your role at ChromaWay and your contributions to Chromia's RWA initiatives, particularly the LDAP?

As the founder of the RWA team at ChromaWay, I concentrate on leveraging Chromia's existing blockchain features and innovating new capabilities to facilitate the issuance and trading of tangible digital assets such as real estate, credit products, equities, and alternatives. LDAP is our foundational protocol designed for the regulatory-compliant tokenization of these assets throughout the capital supply chain. I work with Web3 issuance platforms, direct issuers, and other ecosystem partners to grow the use of the protocol and Chromia-enabling technology in the financial services vertical.

RWA Market Trends

The on-chain RWA market is seeing record highs. What's driving this surge?

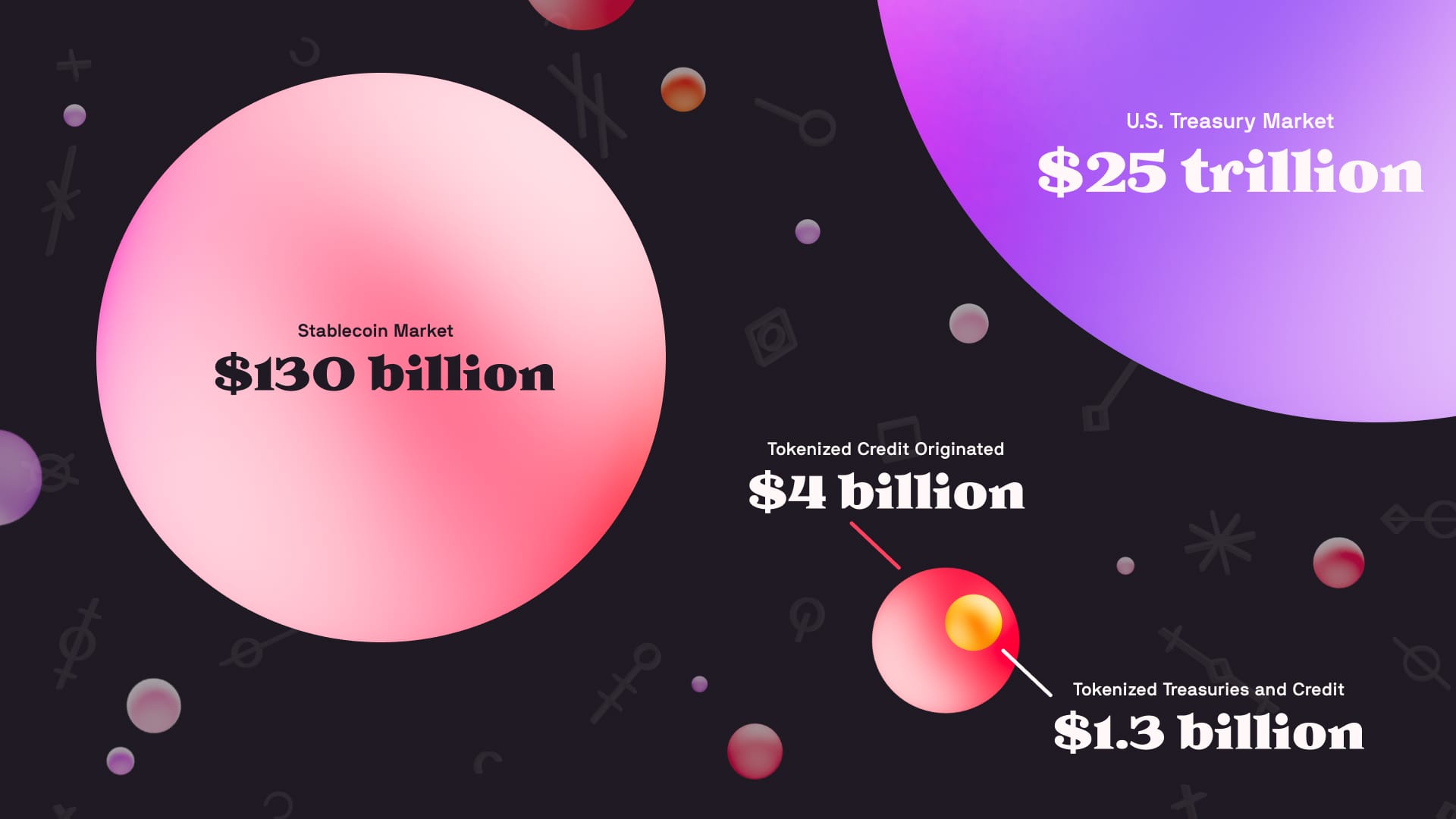

Specific segments, including tokenized treasuries and credit, have amassed over $1.3 billion, with a total of $4 billion in tokenized credit originated. The stablecoin market alone exceeds $130 billion. These figures are modest compared to, for example, the $25 trillion U.S. Treasury market, yet the segment is seeing impressive attention, investment, and growth.

Interestingly, the RWA market continued expanding even amidst a crypto bear market. This growth is driven in the near term by high interest rates, which have enticed stablecoin holders to seek better yields, and by long-term market demand for lower costs, faster settlements, and the benefits of programmable compliance and transparency offered by Web3 solutions.

LDAP on Chromia

An EVM-based LDAP is already in use, and a Chromia version is in development. When do you expect that we will see LDAP on Chromia?

Our initial phase was creating an EVM-based LDAP, designing a protocol versatile enough to blend seamlessly with various chains, token standards, and exchanges.

This approach has provided our technical team valuable insights, particularly in enhancing Chromia's connectivity with different ecosystems and addressing unique challenges in the RWA domain, like investor whitelisting and token custody.

Development is in the design stage, and we are targeting a 2024 release on Shared Appnet. The protocol will also be available on Chromia's mainnet after launch.

What enhancements will Chromia bring to LDAP, compared to Ethereum and other EVM blockchains?

At present, roughly 25% of RWA processes and data are managed on-chain. This is partly because RWA issuance inherently involves both on-chain and off-chain elements. However, a major limiting factor is the data storage capacity of EVMs, which can caps at 40 MB. This is quite restrictive, especially when dealing with extensive documents like investment prospectuses, investor reports, and sponsorship agreements that typically exceed this limit.

Chromia's use of a relational database offers a significant advantage, allowing us to shift a larger portion of these processes and data onto the blockchain rather than relying on external databases. Additionally, Chromia's unique fee structure, which does not employ conventional gas fees, significantly reduces costs for processing various transaction types.

Can you highlight LDAP's distinct features and how it stands out from other solutions?

LDAP stands out with its array of innovative features. Let me list them as bullet points to make them more easily understood.

- It is compatible with all EVM-based chains, enhancing its portability.

- The framework offers a new approach for sponsors to reach a wider array of global investors while significantly increasing transparency and reducing issuance costs.

- Programmable compliance features allow for the direct integration of complex rule sets, such as AML and KYC compliance into the token.

- The smart contract protocol enables fuller automation, streamlining tasks such as minting, transfers, and whitelisting. This efficiency effectively removes the need for and the costs associated with intermediaries.

- LDAP ensures that all transactions are cryptographically signed and time-stamped on-chain. Additionally, for critical transactions, a multi-signature wallet approval process is employed to bolster security.(Developers can review the protocol here to gain a comprehensive understanding of it.)

Early Adopters

How have Bloqhouse, Fund.me, and immotokens benefited from implementing LDAP, and what feedback have they provided?

These initiatives are creating a strong base for broader RWA adoption.

Bloqhouse, having managed over $1 billion in assets through its security issuance and investor management platform, provides a significant opportunity. Their incorporation of DLT issuance for European fund managers and alternative asset issuers is a significant advantage.

The early experiences from projects like fund.me and immotokens are instilling more confidence in a larger group of customers about moving to DLT-based issuance. However, it's important to remember that adopting an RWA approach for securities doesn't automatically lead to increased investor engagement. Traditional tasks like asset quality, effective investor marketing, and customer service remain crucial.

The Future of RWAs

Which asset classes could significantly gain from tokenization?

Examining the broader impact of digitization across sectors like music and retail, it's clear that this transformation will significantly affect all asset types in the investing and lending arenas. Currently, simpler real-world assets, especially in the debt sector, such as US Treasury and credit products for SMEs (small and medium-sized enterprises), are gaining notable momentum. This trend could be a temporary response to the current high-interest rates and global credit tightening, with borrowers increasingly seeking this novel source of capital.

Investors, too, are finding opportunities, with secure returns on investment ranging from 5.5% to 6% for treasuries and even 10% to 12% for credit. However, alternative assets, such as real estate, may experience slower adoption due to their complex regulatory frameworks and challenges in price transparency.

On a personal note, what excites you the most about the potential of RWAs, and where do you draw your inspiration for driving these initiatives forward?

Drawing from my experience at Fannie Mae, I've observed firsthand the large scale of MBS (mortgage-backed securities) issuance, which hit $628.3 billion in 2022 alone.

These bonds, favored by a range of investors from mutual funds to sovereign wealth funds, offer reliable returns but come with notable costs, including brokerage fees, and usually require a hefty minimum investment of around $10,000.

In contrast, the exciting opportunity with RWAs is their potential to democratize access to such investment products. They promise significantly lower costs and more manageable investment thresholds. Technically, the transparency offered by tracking asset issuance and monetary movements (like through stablecoins) on the blockchain is a game changer.

Finally, the prospect of enhancing the liquidity of long-term investments via asset collateralization and DeFi protocols adds another layer of excitement to the unfolding RWA story.

Wrapping Up

Thank you for your time today.

You’re welcome. I'm glad to have been a part of this discussion!

About Chromia

Modern society runs on data and every online service you’re using is built upon underlying databases - ranging from your online bank to music streaming and gaming. Chromia is a relational blockchain - a combination of a relational database and a blockchain - making it easy to develop user-friendly decentralized apps for almost any industry, including DeFi, NFTs, gaming, and more.

Website | Twitter | Telegram | Facebook | Instagram | Youtube | Discord