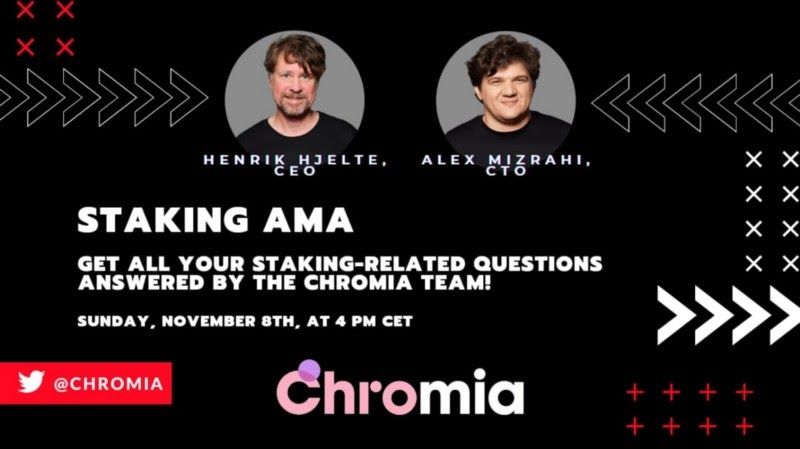

In preparation for the staking launch, we held an AMA with the Chromia community to address any questions regarding staking! We also welcomed general questions relating to Chromia.

Our CEO, Henrik Hjelte, and CTO, Alex Mizrahi, joined the Chromia Telegram group to connect with the community and provide their insights. Many excellent questions were asked - not only relating to staking, but also development, adoption, marketing and much more.

If you missed the AMA live, have a read through this recap to gain some deeper insights into Chromia!

Introductions

Host: Welcome, Henrik and Alex! It’s a pleasure to have you here with us.

Most of us already know who you are of course, but for the benefit of newer community members could you please briefly introduce yourselves and your roles at Chromia?

Alex: Hi everyone!

I’m Alex Mizrahi, CTO of Chromia/ChromaWay. I lead the development team. I’ve been programming since I was 10 years old, and have a wealth of experience in the blockchain and cryptocurrency space. I led Colored Coins from 2012, which birthed the concept of ‘tokens’. I’ve also been heavily involved in blockchain research since the very early days.

Henrik: I’m Henrik, CEO of Chromia and ChromaWay. I’ve also been a developer for a long time, but turned into more of a startup guy. Worked in finance & IT, then a startup where I got to know Alex, and Alex introduced me to bitcoin and his Colored Coins project.

Host: Excellent, great to have you both here! I know the team is always busy BUIDLing 🛠

Introductory Questions

Host: Before we dive into community questions, I wanted to quickly touch on some of the staking-related information previously released to get everyone up to speed.

Can you remind us of the basic details e.g. APR?

Henrik: Sure, here are the key details we previously released:

- Staking yield: 25% APR.

- Staking will be enabled via the official Chromia website.

- Payout frequency: every 30 days.

- No max stake in the first period (2020).

- Minimum stake: 1000 CHR.

Alex: Yea, I’d recommend people to read the full blog post though.

Also these details will be on the staking site once it comes online tomorrow.

Host: Thank you! That covers the basics nicely.

Speaking of the blog post, the team also recently released an article regarding Chromia staking mechanics and staking programs. It was a very interesting read. I wanted to quickly touch upon a couple of the points mentioned in there.

Can you remind us of some of the benefits for Chromia stakers aside from staking rewards? Governance experiments in particular sound exciting.

Alex: Yes, we are going to launch a governance experiment where people with stake can make proposals and vote on them.

This is largely to gauge how interested in the community in governance. If we see solid involvement we’ll try to make sure community influence will be more formal in future.

Governance website will be deployed later this week.

Host: Very nice 👌 I have no doubt we’ll see some solid interest. Many committed Chromians here!

Alex: Proposals, more specifically, it’s not a final version, of course, we’d like to reduce influence of big players (e.g. exchanges) and give more power to normal community members, we have some ideas on this, but it will probably come to implementation in Q1 2021.

Host: Excellent, yes that’s a tricky obstacle to overcome (the weightage of exchanges etc.), but no doubt it can be overcome. Keep the power with the community members primarily.

As we say around here: ‘Power to the Public’.

Alex: Once a user stakes his CHR he gets access to several different things. Provider stake delegation will come online later this month, also 3rd party projects can offer early access and other benefits to CHR stakers.

Host: Very nice! Regarding the provider stake delegation, it says in the article that those delegating their stake to providers will ‘receive a portion of the provider’s reward in return.’

To clarify, delegators will receive their usual staking rewards, plus a portion of the providers’ rewards? How are the providers’ rewards generated, from fees paid by DApps running on the mainnet?

Alex: Strictly speaking, there’s no “usual staking rewards”. Out of box staking does nothing, it just gives an opportunity to engage in various programs which have rewards.

The 25% APR mentioned above is the governance reward.

And yes, provider stake delegation gives users an ability to earn an extra reward on top of that 25% APR, since users can engage in different programs in parallel.

Providers’ rewards are currently subsidized. It’s meant to come from dapp hosting fees, but we don’t have many dapps for now, and we don’t want to tax them heavily.

We have a separate “system node compensation pool” to compensate providers, and providers are free to share these rewards with stakers if they can’t collect sufficient stake themselves.

If the node compensation pool is depleted, we’ll use the ecosystem fund for this. We understand we need a healthy provider ecosystem to appeal to dapps, but we also need dapps to pay providers. To solve the chicken-and-egg problem the ecosystem needs subsidy, which was a part of the original token distribution design.

Host: Excellent, thanks for clarifying! Sounds like there are many levels to Chromia staking; not your usual ‘stake just for the rewards’ but more to nurture a strong community of Chromia enthusiasts. Love it.

Here’s the full article on staking mechanics and programs for anyone that missed it:

https://blog.chromia.com/chromia-staking/

Ok, let’s jump into the main event! Community questions :)

Community Questions

Q1: 25% APR is generous, but do you think the inflation might present an issue?

Alex: There’s no inflation. Initially 250M CHR are allocated as a promotion budget. They aren’t fully utilized right now. Governance rewards will be taken out of the promotion budget, we believe it’s more effective to incentivize the community rather than just airdrop it to disinterested people or something.

Also 25% reward is not forever, it will be reduced as well as requiring additional conditions such as actual participation in the proposal process.

Q2: As we know, projects now focus more on staking and this year more projects are finally on mainnet & most of this year’s projects are more popular for mainnet & DeFi. What about CHR itself, what are the preparations and plans that Chromia should realize?

Henrik: We are preparing for mainnet, and integration with Ethereum as a layer 2 to be able to onboard the “traditional” DeFi architecture that is largely Ethereum based. Hedget is a good example of this. Additionally we are looking to broaden the market for blockchain by attracting new developers with our still unique design, being a proper database. This means it is easier and faster to do dapps. There are many projects being started, and we believe in a ‘ketchup effect’ soon when we can show the ease of use.

Q3: What makes you believe this staking program is gonna bring a new atmosphere to Chromia? How do you assure users that staking is the best choice for Chromia?

Alex: Staking was always meant to be a part of Chromia, and we believe it's the right time to introduce it.

Q4: Does the team anticipate offering a similar APR for governance related activities in 2021?

When do you hope and/or anticipate that the returns generated by network fees will be sufficient to compensate providers and delegators without the need of subsidy?

Also related follow up question: does the team intend to publish a tokenomics report in early 2021 regarding new token issuance and allocations. Similar to the one published in spring 2020 — thanks for your time.

Alex: 1. We’ll create more complex conditions in 2021 so that people who actually participate will get rewards. We don’t have a formula right now, but rewards for users who are active might be similar.

2. Really hard to predict. It would be good if it happens by 2022.

3. Yes.

Q5: Is blockchain for gaming right? Are you working on any big platform like Sony, Microsoft, Epic Games, Steam?

Henrik: Well, blockchain for gaming is currently not done right. A lot of focus is very much “top down”. A new way for a centralized controlled big studio to sell more stuff, now as NFTs. Doing logic on-chain, and giving control to users have been ignored by the blockchain industry. That is where we want to go.

BTW on gaming, there are some projects being started that I've seen that are very much focused on mass market games on Chromia, I can’t disclose the concept yet. Also soon, there will be Chromia integration with Krystopia 2: Nova’s Journey, and day now, and Mines of Dalarnia release.

Q6: What kind of different programs in parallel did you mean? Are they some kind of tasks? + early access to 3rd party programs (you mean as a beta tester?)

Alex: When you stake it just records on blockchain that you have a stake. Various programs can see you have a stake and give you access or rewards.

Yes, beta testers, might also get rewards in tokens, etc.

Q7: To create the Chromia ecosystem, will there be a buyback or burning of a token supply?🤔

Alex: Nothing like that is planned, we believe that giving more incentives to use CHR will be more efficient right now, e.g. dapps collecting CHR and so on. Burning could be a thing in future, but I doubt it will be a substantial factor in 2021, for example.

That is, if we create an incentive for dapps to accumulate CHR that would have MUCH bigger effect than burning.

We can easily imagine dapps locking millions of dollars worth of CHR (many such dapps exist on Ethereum, for example), but it’s hard to imagine why would somebody burn many millions worth of CHR…

For example, let’s say a “crypto twitter” dapp gets popular and gets 1 million users, requiring each user to pay $1 to create an account, that would be 40M CHR locked at current price…

Q8: For each project, community factors contribute to project victory. So, what strategy does Chromia have for community development and long-term user retention?

Henrik: I think this staking program is a “community factor”. In particular for token holders and investors. We have other communities though: “developer community”. We are improving our already good tooling, documentation and developer support. “Entrepreneurs community”: we are improving ways to support projects and builders, and are currently quite active in helping projects.

Then we have the “passive consumers” community. There are now games and dapps being launched that are so easy to use that they can attract a mass market that might not even know the word blockchain. We are quite eager to build that community.

Q9: Is there a staking lock for 30 days or people can withdraw anytime and get reward for the time that they provided staking?

Alex: You can withdraw with 2 weeks notice, i.e. request withdrawal 2 weeks before you do.

You will get rewards for the time it was staked (although that depends, perhaps in future the period after withdrawal is expected is not counted, since the user already indicates he wants to leave).

Q10: Is Malcolm still alive?

Alex: Yes, but he has some personal issues to sort out so not participating much. That doesn’t affect the team much since none of our processes require Malcolm.

Q11: Are we still expecting staking via exchanges to begin soon?

Is there any estimate as to when staking via the Chromia Vault itself will begin?

Alex: No, I guess exchanges will wait until it matures a bit.

No estimate on Chromia Vault — we currently focus on the ability to use existing wallets since it’s definitely more convenient for people and better for security. Vault will be used when we really need it.

Q12: How does Chromia work in managing high-output and multiplayer online games? How is the Dapp infrastructure evolving for games that will require more complex and intensive management in the future?

Henrik: Chromia scalability is on par with other “gaming blockchains”, but allows more complex logic. We have integrations with gaming engines, and will add more. We have several technologies that are unique. From GRA, a new tech that allows super-simple blockchain integration for games, to an NFT architecture called Originals with many advanced and unique features: for example bundling logic (code) with items, and having a marketplace built in. And in the works are now games with millions of users in the target, as well as a game related platform which will be announced rather soon.

Alex: Well, using a real database and sharding ability is a good start, I think. Obviously, we can’t match specialized game servers with a blockchain, but as long as what you need is managing transactions with items it can probably scale to millions of users. And more with sharding.

For things like item transfer it’s probably something like million players per blockchain. If you need more, just run many blockchains.

Q13: Does a person need to have an active stake to get the payout or is everything done pro rata? Ie if a person stakes 3 days before payout day or stakes 15 days then unstakes before payout day do these people still get 3 and 15 days of rewards? Also, does announcing 2 week unstaking intention freeze the accrual of rewards or do they keep earning over the 14 day waiting period?

Alex: It is pro-rata. Currently including withdrawal to make it simpler and user friendly. But later we will likely exclude reward after the user requests a refund.

Q14: If I want to stake CHR, I assume some ETH will be required too? How much ETH will be required?

Alex: ETH required for fees greatly depends on ETH gas price. Our contracts are fairly optimal and shouldn’t require more than a few dollars worth of ETH per transaction, so maybe stake and collect reward will cost you $5. I’d recommend withdrawing something like $10 or more to make sure you don’t overpay for transfers.

Q15: Revenue is an important aspect for all projects in order to survive and keep the project/company up and running. What is Chromia’s way of generating profit/revenue? What is the income model?

Alex: I’ll put it simple — we need to attract dapps. To do that, we need kick ass tech. Unfortunately we don’t have all components ready yet, but we are making good progress, and once we have very attractive tech there shouldn’t be any problem with ecosystem growth (and thus revenues and such).

Henrik: There is not a central “Chromia entity” that has a business model. Instead there are multiple “actors” in the architecture, and they have different ways to make money. Providers earn money by providing resources. Stakers earn money by staking and participating in governance. Dapps have individual business models. Users just enjoy apps, or make money on doing work in dapps. Etc…

Q16: Why did you decide to denote the interest rate in APR as opposed to APY? APY seems to be the more common measure in the industry nowadays.

Alex: I consider it the same thing. Given there’s no compounding I don’t think there's a difference, we’ll probably rename it to APY to make it similar to other sites.

Host: To clarify on this, you mean no automatic compounding? As in stakers will need to manually stake their rewards each month if they want to compound?

Alex: Yes, no automatic compounding. Since rewards are separate from staking itself, there’s no way to do automatic compounding in a general way. Better to keep it simple.

Q17: Every successful project has a few stories behind the scenes, what’s the story behind Chromia’s success? What was that vision when it first emerged as an idea?

Henrik: Some early history. In 2015 one of the founders of LHV Bank wanted to try to create a cryptocurrency app for finance. Basically a stable-coin, EUR. He went to speak with Vitalik and Alex, but decided that Alex had a more secure/stable technology for the real-world, so we started to do a EUR stable-coin with Colored Coins. We knew it wouldn't scale, so started to plan an architecture similar to lightning network. But to accept thin clients and get working performance in the meanwhile, we needed to have faster retrieval for bitcoin. And started to dump the whole bitcoin network to a postgresql database. I think that is when the first idea started to grow, we can make a database be completely integrated with blockchain. Alex knews first when the idea hit him first.

Q18: What important milestones does Chromia aim to achieve by the end of this year and in the future? How will it help you and how will Chromia be successful in 2021 and in the future?

Alex: Well, we are launching staking, for starters :)

Hedget, which would use Chromia blockchain, will launch a beta by the end of the year. This will demonstrate Chromia’s viability for DeFi projects, which hopefully will attract many projects in 2021.

We already see interest from many projects, but we need to polish tech a bit to onboard them.

Q19: Why no stable coin with staking?

Alex: “Staking” of stable coin is usually associated with lending/borrowing interest. We don’t have anything to do with that right now, potentially a project running on Chromia can offer that. But it has nothing to do with CHR staking…

Q20: Which market are you focusing on? How do you rate the Southeast Asia market? Do you have any plans to develop in the Southeast Asia market?

Henrik: We don’t really want to focus geographically, but sometimes it happens that way. We rate Southeast Asia highly. We have developers there, and do business development there, and have investors there. And before Covid I and others frequently travelled there. Even lived for some months in Singapore. We will increase translation efforts, and partnerships, and also we will do a project with a public sector institution in one country. When Covid ends we’ll do more.

Alex: I see many questions on marketing and strategy, I guess I can provide some general overview from the point of view of me as a CTO.

Our market is dapps (and other blockchain applications). Dapps will bring users. We did experiments with many different types of dapps, they went quite well, but we identified some areas we need to improve. Once we polish those areas we believe that we can make Chromia a great choice for launching dapps.

And that’s basically the strategy. Once you launch a successful dapp, more devs see it and consider it for their next project and so on. So we need to focus on features which dapps need.

Of course, there’s a lot more detail which I can’t cover here. For example, DeFi dapps can interact with each other, and reuse components such as token gateways, so once you launch one, others can greatly benefit and strengthen the ecosystem.

Same thing with gaming, we believe that blockchain can enable cross-game functionality, so once you have something, adding more is much easier. (Also once you have a successful game it serves as an example of how to integrate a blockchain with games).

So there’s a number of specific considerations for business development. We aren’t developing tech for the sake of tech, we interact with dapp devs and evaluate their needs and how we can help, etc.

Also I’m more of a tech guy, not marketing or biz-dev, so obviously I’m giving a tech-specific response. Marketing and business development team members might have a different view on this 😂

Henrik: Well yes on marketing, I think adding successful showcase dapps and finishing some things first will be most bang for the buck. Marketing efforts should be done with some cleverness, and at the right time.

Q21: So Vitalik knows about Chromia?

Henrik: Yes. Alex was leading the Colored Coins project, and Vitalik joined at the end to help with some tasks, but then he wanted to start Ethereum. So he knows us, but as you understand he is quite busy with other things so not sure how much details he knows about Chromia’s architecture.

Alex: He definitely knows about me :) I don’t think he follows Chromia since there are literally thousands of projects out there and he mainly focuses on the Ethereum ecosystem.

Also Chromia doesn’t really offer some breakthrough innovation, it’s more of a common sense practical project. That said, perhaps once we launch our fee model maybe Vitalik will find something interesting in it :)

Q22: What is the plan to decentralize the development of Chromia so not only ChromaWay develops it?

Henrik: If you look at open-source/free software, it is most often the case that one company/sponsor develops the large majority of the code. So this is not something unnatural that ChromaWay does a lot of development. But, as the code matures it makes it easier to start to open up for more collaboration in the form of bounties, patches and so on. I’ve been contributing to open-source/free software since 1999 I think, so am all for that.

Alex: People are already contributing to infrastructure, e.g. C# client was done by community members.

But contributions to core need to be tightly coordinated. Maybe once things mature it will be easier to contribute to the core. But also I expect independent devs and companies using Chromia to work more on add-on modules, libs, etc than just jumping in to rewrite the consensus, for example :)

Q23: What happens if the staking contract has a bug and users’ funds get lost?

Henrik: Alex should answer, but from reading the blog it seems a minimal contract design was used to lower the risk of bugs. If there is a bug, the governance forum can decide a representative that will spank me in public, streamed over video as well.

Alex: Yeah, the base staking contract is very simple and tokens getting stuck is basically impossible, but worst case we can just consider those tokens dead and not part of circulation, and give people compensation.

Q24: So the TPS vs ETH and other coins is a true thing

Alex: Probably. TPS is not directly comparable and not the most important metric.

Say, on Chromia if you make a financial app, you can say “at the end of the day, go through all users accounts and update them (e.g. doing settlement)”. It’s not something people can do on EVM.

So we don’t focus on the best TPS, we focus on the best and most practical programming environment for realistic dapp workloads.

E.g. in an exchange dapp I can just query ask with lowest price, it’s natural in Rell. No idea how Ethereum people can do that, there are no indices…

Q25: What made Ethereum so successful then because more TPS = more innovation and more innovation possibilities

Henrik: Define “so successful”. And it is not easy to come up with a definitive root cause of why success occurs. I think a combination of timing, and also that Vitalik had a platform/reputation to kickstart a successful raise of money.

Alex: It was the first platform which was talking about building dapps and made it quite simple to develop and deploy the contract. It’s more-or-less good for DeFi so that direction went quite well.

BitShares has a lot more TPS and it was live since 2014 or something and has built-in DEX, but it didn’t really excite people. So you got the idea…

Q26: Ok so it can handle 1000tps x unlimited in the near future anyhow with a programmed settlement included then

What is a transaction by the way? The T in TPS?

It can be “move some coins between A and B”.

Or in Chromia: a Transaction is a database transaction: “Move 20.000 troops on game-board and settle all battles”.

Or “Pay dividends to all shareholders that have owned shares for more than one year, and are not on a blacklist of known criminals”.

Probably implemented as a single line of code or something (the latter).

Alex: We don’t really have some fixed number of transactions per second, in fact, no project has that.

I believe we have enough TPS for most applications, so it’s not something we are optimizing right now.

The focus is more to enable projects with things like bridges and so on.

Henrik: Oh, and to calculate TPS in a competition between projects. What hardware is used? What network timings? etc. These numbers are largely useless.

And: Is it decentralized or secretly centralized. Even so, we win 😊

Q27: Well thanks for the great answers and ama is mainnet launch soon live?

Alex: There’s a blog post about mainnet:

https://blog.chromia.com/chromia-mainnet-clarified/

First stage of mainnet is already launched, we plan incremental growth rather than a huge launch of all features at once.

Q28: When can I start my Chromia node?

Alex: Not sure, TBH, hopefully within next 3 months.

We are planning some major overhaul so community nodes do not make much sense until that’s done.

Closing Thoughts

Thank you to everyone who attended the AMA! Many excellent questions were asked. It was a pleasure connecting with the community, and we look forward to more such AMAs!

We will continue to spread the word of Chromia and Chromia staking globally — stay tuned for more upcoming AMAs 👀

If you haven’t done so already, you can join Chromia’s announcements channel on Telegram to keep up to date with the latest news: https://t.me/chromia_announcements

Join Chromia’s main Telegram community to get involved in the conversation: https://t.me/hellochromia

If you wish to learn more about Chromia, our public relational blockchain platform powered by Rell, please do not hesitate to contact us or visit:

Website: https://www.chromia.com

Twitter: https://twitter.com/chromia

Facebook: https://www.facebook.com/teamchromia

LinkedIn: https://www.linkedin.com/company/chromia

Telegram: https://t.me/hellochromia